Specialist Mortgage Broker Glendale CA: Simplifying Your Home Financing Trip

Exploring Why Partnering With a Home Loan Broker Can Substantially Simplify Your Home Acquiring Experience

Navigating the complexities of the home purchasing process can be daunting, yet partnering with a mortgage broker supplies a critical advantage that can simplify this experience. By acting as middlemans in between you and a large range of loan providers, brokers give access to tailored funding options and expert understandings that can alleviate potential challenges. Their efficiency not just improves performance however likewise promotes a more tailored approach to safeguarding beneficial terms. As we discover the various elements of this partnership, one may question exactly how these benefits manifest in real-world circumstances and influence your general trip.

Comprehending Mortgage Brokers

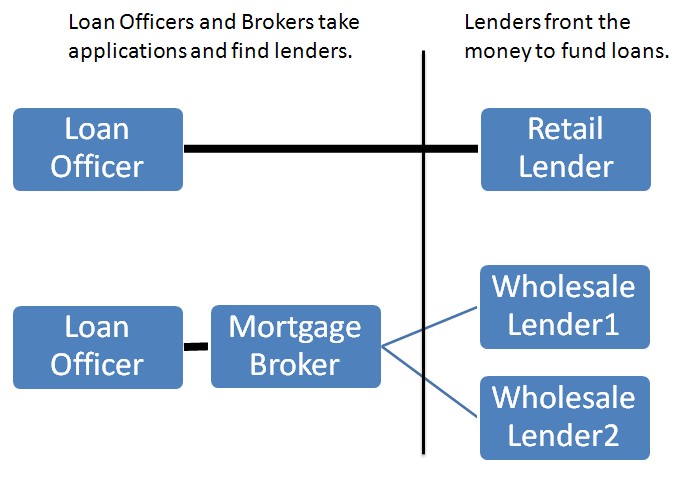

These professionals have in-depth expertise of the home loan industry and its guidelines, enabling them to browse the intricacies of the loaning process efficiently. They aid debtors in gathering required documents, completing financing applications, and making sure that all requirements are met for a smooth authorization procedure. By discussing terms in behalf of the customer, mortgage brokers usually work to safeguard positive rates of interest and problems.

Eventually, the knowledge and sources of home mortgage brokers can considerably simplify the home buying experience, reducing some of the burdens normally related to securing financing. Their role is critical in helping customers make notified choices tailored to their special conditions and monetary objectives.

Benefits of Making Use Of a Broker

Utilizing a home loan broker can provide numerous advantages for buyers and those aiming to re-finance. One substantial advantage is accessibility to a more comprehensive series of car loan alternatives. Unlike financial institutions that may just provide their very own products, brokers collaborate with several lending institutions, enabling clients to explore numerous home mortgage services tailored to their particular monetary circumstances.

Additionally, home mortgage brokers possess extensive industry understanding and experience. They stay educated concerning market trends, interest rates, and lender requirements, ensuring their customers obtain precise and prompt info. This can cause extra desirable loan terms and potentially reduced passion rates.

In addition, brokers can aid determine and resolve prospective obstacles early in the home mortgage process. Their experience permits them to anticipate challenges that may develop, such as credit issues or documents requirements, which can conserve clients time and tension.

Finally, dealing with a home mortgage broker frequently leads to personalized service. Brokers usually spend time in understanding their clients' special needs, leading to an extra customized method to the home-buying experience. This combination of accessibility, know-how, and individualized service makes partnering with a mortgage broker an important possession for any homebuyer or refinancer.

Streamlined Application Refine

The process of requesting a mortgage can commonly be frustrating, yet partnering with a broker significantly simplifies it (Mortgage Broker Glendale CA). A mortgage broker functions as an intermediary in between the borrower and the lending institution, simplifying the application process with professional guidance and company. They begin by evaluating your monetary scenario, collecting necessary files, and recognizing your particular demands, making sure that the application is tailored to your circumstances

Brokers are fluent in the details of mortgage applications, helping you prevent common mistakes. They offer quality on called for paperwork, such as earnings confirmation, credit report records, and property declarations, making it less complicated for you to collect and submit these materials. With their comprehensive experience, brokers can anticipate prospective obstacles and resolve them proactively, minimizing hold-ups and stress.

Accessibility to Numerous Lenders

Accessibility to a varied range of lenders is among the key advantages of partnering with a home mortgage broker. Unlike standard home acquiring techniques, where buyers are often limited to a couple of lending institutions, mortgage brokers have actually established partnerships with a wide variety of financial establishments. This comprehensive network allows brokers to present clients with several lending Clicking Here options customized to their economic situations and special requirements.

By having access to different loan providers, brokers can rapidly recognize affordable rate of interest and beneficial terms that might not be offered through direct channels. This not only enhances the potential for safeguarding a more beneficial mortgage but also broadens the scope of offered items, including specific lendings for newbie buyers, veterans, or those looking for to purchase homes.

Furthermore, this access saves effort and time for buyers. Rather than calling multiple lenders independently, a mortgage broker can simplify the process by gathering necessary paperwork and sending applications to a number of lenders concurrently. This performance can lead to quicker approval times and a smoother total experience, allowing customers to focus on discovering their ideal home rather than navigating the intricacies of home mortgage choices alone.

Individualized Advice and Assistance

Browsing the home mortgage landscape can be overwhelming, however partnering with a home mortgage broker offers customized guidance and support customized to each customer's details demands. Mortgage brokers act as intermediaries, recognizing private economic scenarios, choices, and lasting objectives. This individualized approach guarantees that clients get advice and solutions that align with their unique circumstances.

A competent home loan broker conducts complete evaluations to identify the ideal funding alternatives, considering factors such as credit report, income, and debt-to-income proportions. They also enlighten clients on various home mortgage products, aiding them understand the ramifications of different passion fees, terms, and rates. This expertise equips clients to make enlightened decisions.

Additionally, a mortgage broker provides recurring support throughout the whole home acquiring procedure. From pre-approval to closing, they help with interaction between lenders and customers, dealing with any concerns that may occur. This continual support reduces tension and conserves time, enabling clients to concentrate on finding their dream home.

Conclusion

To conclude, partnering with a mortgage broker uses many advantages that can significantly boost the home getting experience. By offering accessibility to a broad range of car loan alternatives, assisting in a streamlined application process, and offering experienced assistance, brokers efficiently mitigate obstacles and lower stress for buyers. This expert assistance not just enhances performance but likewise raises the probability of safeguarding favorable car loan terms, ultimately adding to a more gratifying and successful home buying trip.

Browsing the intricacies of the home acquiring procedure can be complicated, yet partnering with a home loan broker provides a critical benefit that can streamline this experience.Home loan brokers serve as middlemans in between lenders and customers, facilitating the financing procedure for those seeking to buy a home or re-finance an existing home mortgage. By improving the application, a mortgage broker enhances your home buying experience, allowing you to focus on finding your dream home.

Unlike typical home getting linked here techniques, where customers are typically limited to one or two loan providers, mortgage brokers have developed relationships with a large range of economic establishments - Mortgage Broker Glendale CA.Navigating the home loan landscape can be frustrating, but partnering with a home loan broker supplies personalized guidance and assistance tailored to each client's specific requirements